Government borrowing in the UK soared to £20.5 billion in April, marking the highest level in three years. The surge was driven by a growing benefits bill and decreased tax revenues following cuts to national insurance contributions.

Official figures from the Office for National Statistics (ONS) revealed that borrowing exceeded both the £19.3 billion anticipated by economists and the £19 billion forecast by the Office for Budget Responsibility (OBR). The ONS highlighted that the government spent more than it earned in April, with a significant £2.1 billion increase in welfare spending due to an annual inflation-linked uprating at the start of the new financial year.

In addition to rising welfare costs, departmental spending increased by £2 billion due to higher operating expenses driven by inflation. The government’s decision to cut national insurance by two percentage points, effective in April, further impacted revenues, reducing national insurance contributions by £1.5 billion. This cut was the second within four months.

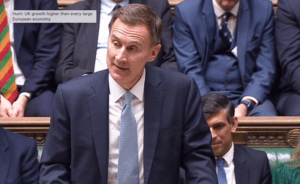

Chancellor Jeremy Hunt had hinted at the possibility of another reduction in the national insurance rate this year. However, the International Monetary Fund (IMF) has cautioned against this move, highlighting the potential cost to public finances. On Tuesday, the IMF suggested that any new government would need to raise taxes or cut spending by approximately £30 billion to reduce debt over the next five years. Both the Labour and Conservative parties have pledged to adhere to the current fiscal rule to lower the debt ratio over the next parliamentary term.

The ONS reported a debt ratio of 97.9% of gross domestic product (GDP) in April, slightly better than the forecasted 98.1%. However, these figures are provisional and subject to revision based on more accurate estimates of tax receipts and government spending.

Grant Fitzner, chief economist at the ONS, stated, “While central government spending and income overall both rose on this time last year, a large drop in national insurance contributions meant receipts did not grow as fast as spending. Falls in expenditure on energy support were offset by increases in benefit spending from the annual uprating.”

For the financial year ending March 2024, the total borrowing bill is now projected at £121.4 billion, surpassing the OBR’s forecast of £114 billion. This overshoot highlights the ongoing fiscal challenges as the government navigates increased spending pressures and reduced tax revenues.

Read more:

Rising Benefits and Tax Cuts Push UK Borrowing to Three-Year High