The multi-year slump in UK car production has yet to reach the bottom, as new figures revealed that factory output fell by a further 11 per cent in April.

Assembly lines around England, as well as Aston Martin’s plant in south Wales, produced only 60,500 cars last month. That is also a 60 per cent drop on the 149,000 cars produced in April 2016 in the months leading up to the referendum on EU membership.

Prior to the Brexit decision, the industry had been talking about hitting record annual production of two million vehicles. The current run rate suggests a figure nearer 750,000.

More than 70 per cent of UK production is centred on the factories of Jaguar Land Rover in the West Midlands and Merseyside, Nissan in Sunderland, and BMW Mini at Cowley in Oxford.

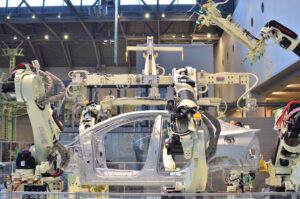

Each of those manufacturers is going through big and lengthy transitions to produce electric variants of their models as the UK and Europe eye a ban from the end of this decade on petrol and diesel-only vehicles.

The Society of Motor Manufacturers and Traders (SMMT), which collates the figures, said that the microchip shortages bedevilling the industry are to blame for the latest factory-gate fall.

The 11 per cent drop in April means that, at 268,000 units, factories have produced 28 per cent fewer cars so far this year.

The carmaking industry is a tale of two halves. Among the other volume producers of recent years, Honda at Swindon has closed and taken its electric car production plans back to Japan; the Vauxhall Astra plant at Ellesmere Port is in rundown, to be replaced by a reconfigured low-volume producer of electric vans; and Toyota near Derby is at historically low production rates.

Meanwhile, in the luxury sector, Bentley at Crewe, Rolls-Royce at Goodwood, and Aston Martin have been at or near full production or are growing assembly rates.

The industry’s supply chain and structural issues are being exacerbated by soaring energy prices, and Mike Hawes, the SMMT’s chief executive, said that, like households, car factories are in need of financial help: “UK automotive manufacturing needs relief equivalent to that afforded to energy- intensive industries and access to low- cost and low-carbon energy comparable to European competitors.”

Read more:

British car production still stuck in the slow lane