Is Robinhood Gold worth it?

That’s a question only you can answer for yourself. So make sure you’re informed. No, I’m not a huge fan of this broker.

Robinhood account holders are telling me they don’t see what’s hot, they don’t realize the there are 70+ GIANT OTC winners on my @StocksToTrade scans up 50%+ more with volume of tens or hundreds of millions shares traded, read https://t.co/0STjlYcAhD get a better broker!

— Timothy Sykes (@timothysykes) February 8, 2021

But also I know Robinhood is a big reason many newbies get into trading.

If you’re one of these new traders — I want you to succeed. The reason I teach is to show traders how to become self-sufficient. I don’t have it in for Robinhood traders. I just have problems with the broker…

When will Robinhood users realize they’re getting screwed as RH can’t handle Supernovas like $GME $KOSS & now $AMC this is why I use Etrade/Interactive Brokers as bigger brokers aren’t great, they’re just more competent. Robinhood SUCKS! #AMCSTRONG #AMCSqueeze #AMCARMY #memestock

— Timothy Sykes (@timothysykes) June 2, 2021

If you’re still deciding on a broker and wondering if Robinhood Gold is worth it, this article might help.

I’ll give you a Robinhood Gold review and tell you what you should expect from a broker…

We’ll talk about Robinhood Gold’s benefits and shortfalls. Then you can make your mind up for yourself.

Read on…

What Is Robinhood Gold?

Robinhood Gold is the broker’s premium version.

Access to the basic version of Robinhood is free. But its commission-free trading is no longer a draw. Most other brokers now offer the same deal.

So Robinhood Gold is the broker’s attempt to give users something more.

For a monthly fee, Robinhood Gold lets you trade on margin. It gives you access to Level 2 quotes that may be laggy and Morningstar analysis.

Robinhood Gold also gives you greater instant deposit power. Users of the fee-free version can immediately trade with up to $1,000 deposits. Robinhood Gold ups this limit to $50,000 … under some conditions.

A few years back, Robinhood Gold’s trading hours were also an improvement on the no-fee version. But since 2018, all Robinhood users can trade from 9 a.m. to 6 p.m. Eastern.

The broker has a following. As of July, Robinhood has 22.5 million users. Robinhood Gold is the broker’s attempt to give its users a competent trading platform. But its features aren’t unique to day trading platforms or other brokers.

How Does Robinhood Gold Work?

Robinhood Gold has the same minimalist interface as its free version. A lot of newbies start trading through Robinhood, so this feature might be helpful to them.

There are many Robinhood Gold threads on Reddit dedicated to its functionality. This can be a good thing since one way to improve your trading is by talking with other traders.

If you have specific questions on how to use Robinhood Gold, the answers are just a Google search away!

But Robinhood Gold shows you the same laggy real-time quotes you find on the broker’s fee-free version. This means you’ll be trading with worse information than better-equipped traders.

Below its price chart, you’ll see some basic stats on the stock. Scroll down further, you’ll see basic analyst ratings. This is the same information you find on the unpaid version … or any free trading resource out there.

Scroll further, and you can see the full Morningstar report on the stock. This option is exclusive to Robinhood Gold.

Morningstar is a respected investment firm. Its analysis is sober and conservative. But it doesn’t give trading tips — it mainly covers a stock’s long-term outlook.

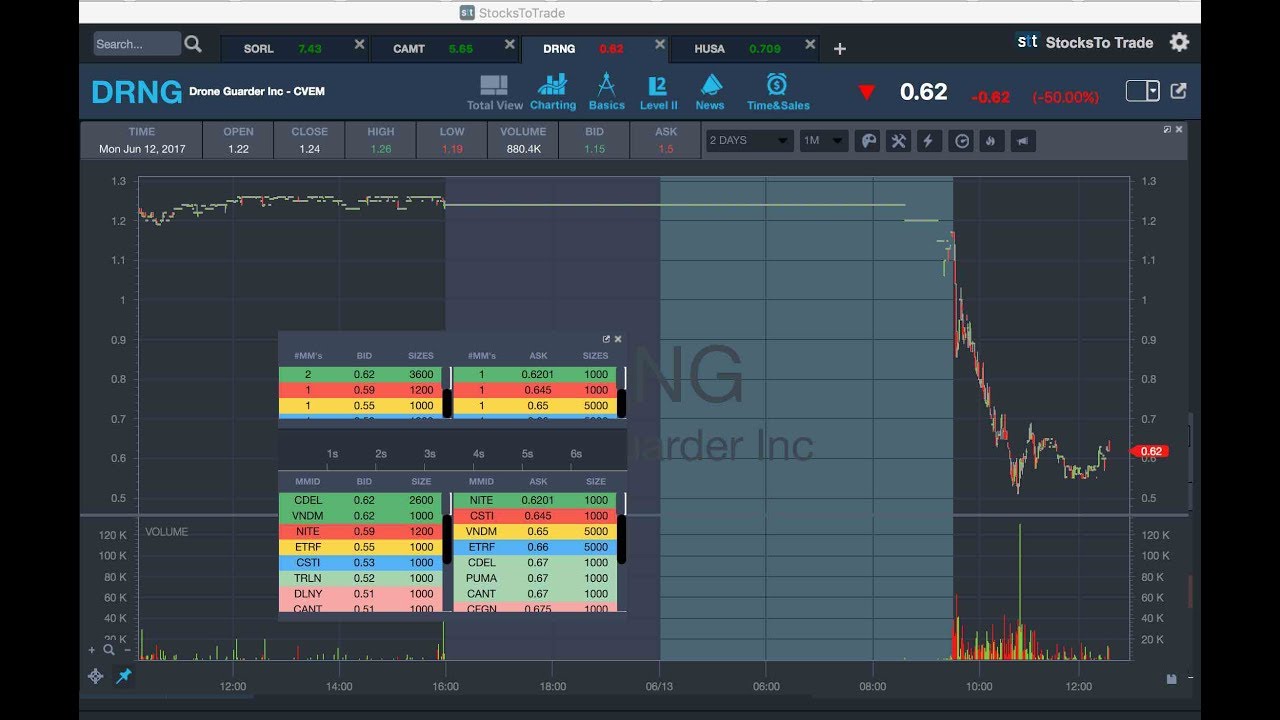

Another feature exclusive to Robinhood Gold is its order book. The service delivers Level 2 quotes. Level 2 quotes can be a big part of your trading strategy. Check out my “Learn Level 2” DVD here. It’s six hours of Level 2 strategy. This data can help you identify support and resistance in a stock.

But it’s less helpful for listed stocks. Level 2 strategies work best on OTC stocks — which Robinhood doesn’t let you trade.

How Is My Margin Interest Calculated?

Another draw of Robinhood Gold is its low margin interest rates.

With Robinhood Gold, you get $1,000 in interest-free margin. Everything above that is calculated at 2.5% interest. This is low compared to other brokers, but it’s also not the full story.

If you short sell, you’ll have to pay borrow fees. These vary with the stock. Some stocks won’t have shares to borrow. Others will be available at high rates.

There are also FINRA-mandated fees. On smaller trades, these will be just a few cents. But this all adds up and impacts your trading plan.

Margin trading can be a powerful tool. Or it can be a ticket to blowing up your account — fast. When you trade on margin, you multiply your profits … and losses.

My #1 rule is to cut losses quickly. That’s even more important when you trade on margin.

How Much Is Robinhood Gold?

The price of Robinhood Gold is $5 a month. There’s even a 30-day free trial.

Is Robinhood Gold worth it? That’s up to you.

Choosing a broker is a personal decision. It depends on your trading strategy and preferences. I can’t tell you which broker you’ll like best. You have to figure this out yourself.

I will give you some perspective, though. What you measure Robinhood Gold by shouldn’t be its cost…

To me, one of the biggest factors is the potential opportunity cost. If you’re only using Robinhood Gold and no other trading platform, you can miss so much.

That’s a problem because experienced traders have much better weapons.

It blows my mind people still aren’t using @StocksToTrade or brokers listed at https://t.co/Ens8xBmXPm and missing fucken gimmies like $KBEVF $SHMP $MTP or $PURA due to not seeing Level 2 or not being able to trade them at shitty Robinhood…be better prepared, stop wasting $!

— Timothy Sykes (@timothysykes) February 28, 2019

The trading platform I use is StocksToTrade.* It has all the capabilities of Robinhood Gold — and much more! Here’s a quick overview…

- Clean and customizable charts. StocksToTrade charts also have more options than the five indicators offered by Robinhood’s web platform.

- Trader-designed stock screeners. Active traders (including me) designed StocksToTrade’s built-in stock screeners. I don’t think Robinhood Gold can compare at all here.

- A wide-ranging news scanner. Robinhood’s news feed is pretty much what you’ll get on Google. StocksToTrade puts Twitter mentions, SEC reports, earnings, and more alongside mainstream news stories.

- Awesome add-on services. Want Level 2 quotes? Alert services? Chat rooms? StocksToTrade has them — and they all can help you in your trading day.

Grab your trial of StocksToTrade today — it’s only $7 for 14 days.

Does Robinhood Gold Give You Money?

Many newbie traders out there think Robinhood Gold gives you money…

No, Robinhood Gold doesn’t give you money. No broker gives away money.

Whether you join Robinhood Gold or its free version, what you may receive is a stock. This is similar to other broker promotions.

Your free stock’s value can be up to $200. But check the fine print — 98% of users receive a stock worth less than $10.

So what does Robinhood Gold get you?

Robinhood Gold advertises $1,000 in interest-free margin. But they’re not giving this away. This is a loan you can use as leverage for a margin trade…

If the trade fails and you don’t cut losses quickly, you’ll owe Robinhood money.

I know Robinhood looks like a video game to some. But you don’t get multiple lives. If you make bad margin trades, you’ll likely blow up FAST.

There’s only one case where Robinhood Gold users might actually be given money. Robinhood just incurred the largest penalty FINRA has ever handed out. This is for the broker’s March 2020 service outages and misleading communications.

Robinhood issues a statement as to why it’s crashing, basically saying they suck and admit it for once

— Timothy Sykes (@timothysykes) March 2, 2020

As part of the penalty, Robinhood has to pay $13 million to users harmed in this episode.

Robinhood Gold Advantages

If you use Robinhood but want an upgrade, Robinhood Gold has some advantages over the unpaid version. Depending on your perspective, there may even be advantages over other brokers.

Let’s break them down…

Its Margin Rates Are Low

If you’re used to other brokers’ margin rates, Robinhood Gold’s rates will come as a surprise.

Most brokers start their margin rate calculations from the broker call rate. This is the basic interest rate used in loans between banks.

Robinhood Gold doesn’t do that. The interest it charges is half to one-third the rate of most other brokers.

You Can Short Sell

This isn’t an advantage over other brokers. Shorting is a standard strategy that most brokers allow.

But shorting isn’t possible with a free Robinhood account. You can only open a margin account with Robinhood Gold. Without a margin account, you can’t short sell.

It Has Better Tools

I don’t love Robinhood Gold’s Level 2 quotes. But they’re better than nothing.

The Morningstar investment reports don’t do much for me either.

My trading strategy is based on news catalysts and technical analysis. Morningstar’s fundamental analysis is for a different type of trader.

Active traders like me focus more on short-term trends. But this isn’t everyone’s approach.

If these tools work for you, that’s great. Just be honest with yourself. That means tracking your trades in a trading journal. I’d also try brokers besides Robinhood to find your best fit.

Robinhood Gold Drawbacks

OK, here’s the bad news.

I don’t criticize Robinhood because of some personal agenda. All brokers have their issues. There’s no perfect broker out there.

But Robinhood has more issues than most. And yes, this even applies to the paid version.

You Can’t Trade OTC Stocks

This is my biggest issue with Robinhood.

Robinhood says it wants to democratize trading. And yes, it has given millions of young traders their first trading experiences.

Its business is based on catering to small-account traders. It started the commission-free revolution, which is now an industry standard.

And yet they don’t have access to OTC penny stocks — the stocks that have helped me make $7.2 million in my trading career so far.**

I trade these stocks because I think they’re the best way to exponentially grow a small account. That’s why I start each year with $12,000. I want to show my Trading Challenge students what’s possible.

Many Robinhood traders are interested in penny stocks. And yet their broker won’t let them trade most of the penny stocks out there.

This is my top argument for staying away from Robinhood.

Learn more about these stocks in my FREE guide to penny stocks.

They Haven’t Always Had the Best Executions

Robinhood Gold works in ways that aren’t always obvious but can impact your trading…

FINRA and the SEC have investigated the broker for failing to get the best executions. This is when a broker doesn’t get the best price possible for its customers’ trades.

There are several reasons why this can happen. They get more than other brokers for selling their order flow and have frequent service outages. They have a basic trading platform made for newbies.

Whatever the case, Robinhood customers haven’t always gotten the best price for their orders.

Their Quotes Are Laggy

Compared with other trading platforms, you’ll see a lag for Robinhood Gold. This lag isn’t huge. All platforms have some lag and occasional service interruptions.

But if you’re a day trader like me, you know that any delay will impact your trades.

How to Open a Robinhood Account

If you’re still set on using Robinhood Gold, their sign-up process is easy. With the required minimum, they’ll automatically set you up with a margin account.

But if you take one thing away from this article, it should be this: Choose your broker carefully. You’re trusting them with your money.

Learn more on how to choose your broker.

Robinhood Gold: Frequently Asked Questions

Let’s go over some of the most frequently asked questions about Robinhood Gold…

Margin Isn’t for Me: Should I Still Use Robinhood Gold?

Margin trading is one of the biggest draws for Robinhood Gold. But no, you don’t have to trade on margin if you opt for a Gold account.

When Will Robinhood Be Available Outside of the U.S.?

You can use Robinhood in most countries. But you can only trade U.S.-listed stocks.

Can I Have More than One Robinhood Account?

You’re only allowed one Robinhood brokerage account. If you’re going to open a second account, do some research and consider trying one with another broker.

Do I Own the Shares I Buy Through Robinhood?

If you have non-margined long positions through Robinhood, those stocks are yours. You can even transfer stocks to another broker for a $75 fee.

Conclusion: Is It Worth Getting Robinhood Gold?

Robinhood Gold has some fans out there…

I’m not one of them. But you’re the only person who can determine what works for you.

Whatever your decision, I want to offer you support. Trading can be a wonderful lifestyle — If you don’t blow up your account with short-sighted strategies.

Want to learn the strategies I’ve used in my 20-year trading career? Apply to my Trading Challenge.

It’s where you can learn from my experience, process, rules, and much more. Note that my team and I don’t accept everyone. I want to work with only the most disciplined traders. Serious about trading? It might be for you.

Do you think I judged Robinhood Gold fairly? Which broker do you use? Let me know in the comments — I love hearing from my readers!

Disclaimers

*Tim Sykes has a minority ownership stake in StocksToTrade.com.

**This level of successful trading is not typical and does not reflect the experience of the majority of individuals using the services and products offered on this website. From January 1, 2020, to December 31, 2020, typical users of the products and services offered by this website reported earning, on average, an estimated $49.91 in profit.

The post Robinhood Gold: The Good, the Bad, and the Ugly appeared first on Timothy Sykes.