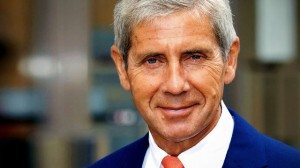

Lord Rose, Chairman of Asda, has voiced his embarrassment over the supermarket’s recent decline, particularly under the stewardship of the Issa brothers.

In a candid interview with The Telegraph, Rose acknowledged the challenges Asda faces, revealing his concerns over the company’s dwindling performance and market share.

Following a 2.1% decrease in like-for-like sales in the first half of the year, Rose offered a forthright critique of the supermarket’s trajectory. “To be perfectly honest, I’ve been in this industry for a long time, and I am slightly embarrassed. I won’t deny that,” Rose remarked. “I don’t like being second, third, or fourth. If you look at the comparative numbers from Kantar or other indexes, we are not performing as well as we should be. And I don’t like that.”

Since the Issa brothers acquired Asda in 2021, the supermarket’s market share has fallen from 14.8% to 12.7% as of July. In contrast, competitors such as Aldi, Lidl, and Tesco have made significant gains.

Rose, the former CEO of Marks & Spencer, suggested that co-owner Mohsin Issa should step back from the day-to-day operations of Asda. “I wouldn’t encourage him to intervene in operations, and I am the chairman,” he stated, implying a need for more experienced retail leadership as Asda grapples with its challenges.

Having served as Asda’s chairman since shortly after the £6.8 billion takeover, Rose plans to take a more active role in the supermarket’s recovery while it searches for a full-time chief executive to assume leadership in the new year. Meanwhile, Asda has announced plans to invest tens of millions in additional checkout staff, acknowledging that the push towards self-checkout has gone too far.

Mohsin Issa, who retains a 22.5% stake in Asda alongside private equity firm TDR Capital, is expected to shift his focus towards EG Group, the petrol forecourt business where he initially found success. Rose noted that Asda now requires a different type of leader, saying, “We always said Mohsin was a particular horse for a particular course. He is a disrupter, an entrepreneur, an agitator. We’ve added a significant number of stores and made many changes, but now it needs a different animal. In the nicest possible way, Mohsin’s work is largely complete.”

Zuber Issa, Mohsin’s brother, sold his stake in Asda earlier this year as part of a broader separation of the Issas’ business interests, following internal family disputes.

Rose also pointed out that under Mohsin’s management, Asda had lost focus on its customers, becoming overly absorbed in an £800 million IT overhaul dubbed Project Future. This project aims to disentangle Asda’s systems from those of its former owner, Walmart, a process that has proven complex and time-consuming.

Reflecting on the transition, Rose, who visits Asda’s Leeds headquarters weekly, said: “Walmart owned Asda for 20 years and ran it as a business that was not a core part of its global operations. While we have focused intensely on certain aspects, we may have taken our eye off the ball in others. I still see myself as a shopkeeper, and when I walk into a shop, I try to view it through the customers’ eyes.”

The IT project is slated for completion by the end of the year, with significant financial penalties looming if delayed. However, Rose emphasized the importance of a smooth transition, even if it incurs additional costs. “There is an incentive to finish on time, but if it means paying a bit more to ensure the safety of the transition, then I’d pay a little bit more,” he concluded.

Read more:

Asda’s struggle under Issa brothers draws criticism from Chairman Lord Rose