The United States and European Union have narrowly avoided a full-blown trade war. The two sides reached a deal on Sunday, July 27, after months of rising tensions and last-minute negotiations.

The agreement imposes a 15% tariff on most EU exports to the US, halving the 30% rate previously threatened.

But for Europe, this was not a win. It was damage control, bought at a high price.

What’s now being described as the “least-worst outcome” came after months of retaliatory threats, escalating rhetoric, and uncertain diplomacy.

With tariffs set to rise sharply on August 1, European leaders conceded to a US proposal that links trade relief to billions in future energy and military purchases.

The agreement stops further escalation. But it leaves Europeans with higher export costs, deeper dependence on US energy, and few levers of their own.

How we got here

This deal did not emerge overnight. It was months in the making, with the first warning signs flashing in early spring.

In March 2025, the US introduced steep tariffs on EU goods, starting with cars and industrial equipment.

By April 9, those tariffs were set at 25% and were later reduced temporarily to 10% during a 90-day pause in exchange for continued negotiations.

The EU responded with its own tariff package, targeting up to €26 billion worth of American exports, including soybeans, motorcycles, and food products.

These countermeasures were held back as long as discussions continued. But behind closed doors, both sides were preparing for the worst.

President Trump made it clear that tariffs could rise to 50% by August if no deal was struck. Brussels feared a new version of the 2018 trade war, but this time without the backing of WTO rules.

Negotiations reached a turning point in mid-July, when it became clear that Europe would either accept a permanent increase in US tariffs or offer up large concessions that could destroy the US-EU trade relationship.

In a final meeting at Turnberry in Scotland, European Commission President Ursula von der Leyen and Trump signed off on a framework.

It included a permanent 15% tariff, selective exemptions for key sectors, and binding economic commitments by the EU.

The trade-off Europe made

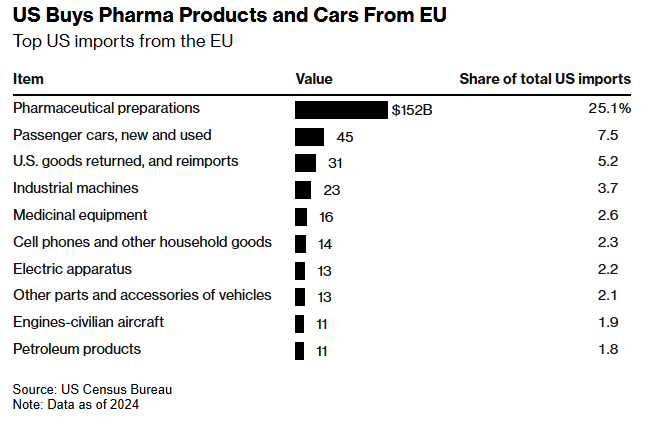

The key element of the deal is the 15% tariff on most European exports to the US. This applies to goods including automobiles, pharmaceuticals, semiconductors, and machinery.

While lower than the threatened 30%, it is still more than seven times the previous average US tariff on EU goods, which averaged around 1.2% before.

But the real cost for Europe is buried in the fine print: a commitment to purchase $750 billion in US energy and to invest $600 billion into the US economy, much of it earmarked for military equipment and industrial projects.

These aren’t normal trade concessions. They’re a form of capital transfer that will pull European purchasing power into American infrastructure and defense.

The structure of the agreement creates asymmetry. The US gets tariff revenue and locked-in demand.

The EU gets temporary access to a slightly less hostile trade environment. The long-term implication is clear: Europe has traded flexibility and strategic autonomy for short-term relief.

Europeans will feel the pressure

Exporters across the continent will be squeezed. Germany’s auto sector, which once enjoyed predictable access to the US market, will now face higher duties on every vehicle shipped.

The VDA, Germany’s car industry body, has already warned of annual losses in the billions.

VW reported a €1.3 billion hit to earnings in the first half of 2025 alone.

The effects won’t be limited to exporters. Energy purchases from the US, particularly liquefied natural gas and nuclear fuel, will be more expensive than alternative sources from Norway, North Africa, or domestic renewables.

As a result, the deal could drive up industrial energy costs across the EU.

This creates a quiet inflation channel that few policymakers are acknowledging.

Strategically, the deal weakens Europe’s push for autonomy. By binding itself to US military procurement and energy flows, the EU has handed Washington more economic leverage than it had before.

France has already called it a “submission.” And in Ireland, where pharmaceutical exports to the US are vital, opposition parties have criticized the agreement for putting national interests at risk.

What investors should really pay attention to

The initial market reaction was positive. The euro ticked up, equity futures rose, and energy stocks outperformed. But the real story is in the capital shifts.

The $750 billion energy commitment provides a multi-year runway for US energy producers.

LNG terminals, shale exporters, and nuclear fuel suppliers stand to gain from Europe’s enforced demand.

The $600 billion investment package supports US defense stocks and infrastructure contractors, especially those tied to aerospace and military tech.

For EU companies, the picture is less attractive. Exporters will struggle to maintain margins. Pharma, autos, and chemicals are all at risk.

The deal effectively tilts the playing field away from European industrials and toward American suppliers.

There’s also uncertainty around compliance. The US retains the right to raise tariffs again if the EU fails to meet its investment or energy targets.

That conditionality introduces a new kind of trade risk, one not governed by WTO dispute resolution but by presidential discretion.

What comes next

This agreement is a pause, not an end. The legal text is not finalized. Tariff exemptions on agriculture and spirits are still in dispute.

The EU may attempt to push for quota conversion on steel and aluminum. If it fails, expect renewed tension in 2026.

Trade diversification is also back on the table. Europe is now accelerating talks with CPTPP countries and re-engaging with partners in Asia and South America.

The goal is to reduce reliance on the US and regain negotiating leverage.

Domestically, the EU will have to decide how to support sectors hit hardest by the tariff hike.

Some countries are already exploring subsidy programs or alternative trade credits. But these come with budget constraints and legal risks.

Finally, while European tariffs on US goods are selective, higher costs on US inputs, especially energy, may pass through to European prices.

The US-EU trade deal may have prevented a crisis. But while Europe has stopped the bleeding, it hasn’t healed the wound.

The post US-EU trade deal: a win for Trump, a blow for Europe? appeared first on Invezz