The oil market may employ a wait and watch approach when the dust settles and the votes are counted in the 2024 US Presidential election next week.

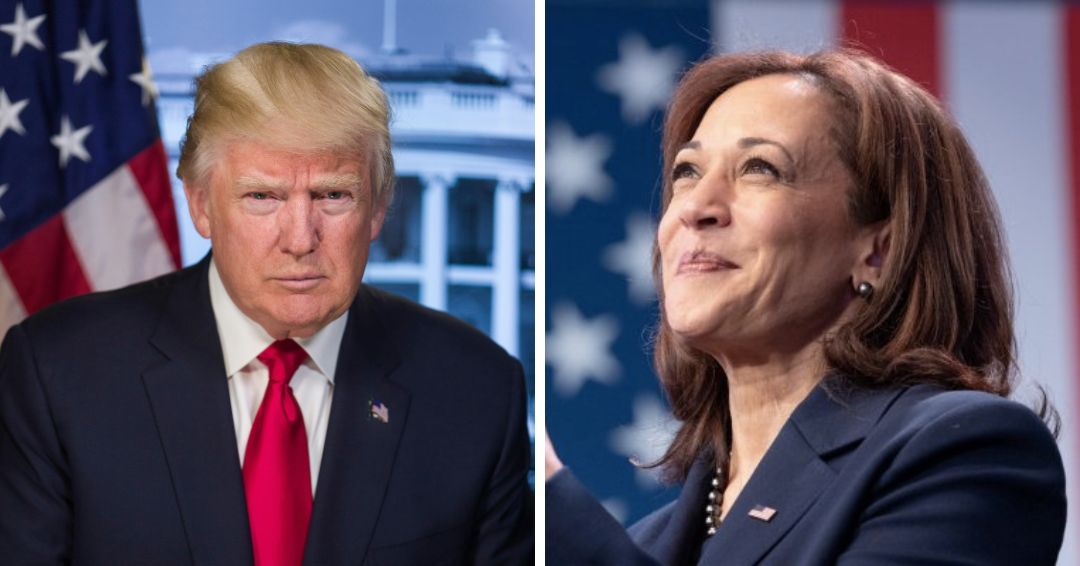

Experts believe it is not possible to make a clear statement as to whether a second presidency for Donald Trump would be better for oil markets than a Kamala Harris tenure.

Both candidates have earlier said that they will not get rid of fracking, but their divergent views on climate and fossil fuels have kept the energy markets on their toes.

“Answering the question of which of the two candidates would be better for the oil market is not straightforward,” Carsten Fritsch, commodity analyst at Commerzbank AG, said.

Fritsch added:

Trump is seen as better for the oil industry because he would reduce existing environmental regulation. Harris, on the other hand, is likely to maintain the regulation.

Kamala Harris’s stance on fracking may sway swing states

There are different views as to whether Vice President Harris would also introduce restrictions on fracking.

The Joe Biden administration prioritised support for renewable energies and tightened regulatory restrictions on the oil industry.

During Biden’s tenure as President, a ban was imposed on drilling licences on federal land.

Harris in 2019 had said that she wanted to ban fracking, but changed her views when she became President Biden’s running mate. Currently, she is in favour of fracking, and would not ban it if elected president.

Since one of the key swing states in this year’s election, Pennsylvania, is home to the largest shale gas deposit in the US, the stance on fracking could prove to be decisive, according to Commerzbank.

Donald Trump in favour of more drilling

Meanwhile, Trump has said that he intends to increase fracking leases on federal lands.

“We will drill, baby, drill,” Trump had famously said during the summer at the Republican National Convention.

Fracking is a technology, where liquid is injected into wells drilled into the earth in order to extract oil or gas.

“There is definitely a push towards cleaner fuels and EVs (electric vehicles) with the current administration and a Harris win would mean a continuation of those policies,” Rohit Rathod, senior market analyst at Vortexa, a real-time energy cargo tracking and freight market analysis company, told Invezz.

Rathod noted:

This won’t mean a concentrated push away from oil exploration, but some policies such as a ban on drilling permits on federal lands to continue. This is actually just to gain favour with their voter base since in reality, most of the drilling in the Permian and other shale basins takes place on private lands and doesn’t impact oil exploration hugely.

Policy on sanctions

Trump withdrew from the Paris Agreement, but Biden had reinstated the deal on his first day in office. Trump had also rolled back more than 100 environmental regulations during his four years in office between 2017 and 2021.

The Paris Agreement is a legally binding international treaty that aims to reduce greenhouse gas emissions and adapt to the effects of climate change.

Trump reinstated sanctions on Iran after withdrawing from the agreement, which led to a significant decline in Iran’s oil production during his presidency.

By 2020, Iran’s production had halved to around 2 million barrels per day.

At 3.4 million barrels per day, Iran has now reached its highest level since autumn 2018, although the sanctions against Iran remained in place. “Apparently, the Biden administration has not pursued their enforcement with the necessary vigour,” Commerzbank’s Fritsch said.

If Harris wins, she is likely to continue with the Biden administration’s approach to sanctions, with tougher sanctions focused on Russia, according to experts.

Russia sanctions: Trump hints at easing in exchange for peace deal

On the other hand, Trump may ease sanctions on Moscow in exchange for a peace deal with Russia and Ukraine. He is also likely to reinstate the sanctions on Iran and limit its production.

Trump may also be opposed to sending US troops to Ukraine.

Fritsch said:

Strict enforcement of Iran sanctions would presumably result in a conflict with China, which is considered the largest buyer of Iranian oil. Trump is more likely to be inclined to do so than Harris.

“Trump has said that he wants to end the Russia Ukraine conflict, if that means he will ease sanctions on Russia still remains to be seen,” Rathod said.

Experts said that the control of the Congress will be key to making decisions if Trump takes office for the second time.

“He has promised a lot of things including controlling illegal immigration and tax benefits. He will have to choose one and most likely won’t be able to act on all fronts immediately. The control of the congress will be important for him to push forward with his promises, control of which is currently still with the democrats,” Rathod added.

Trump’s foreign policy shifts may drive oil market volatility

Experts believe that oil prices may briefly rise if there are any uncertainties with the outcome of next week’s election.

“Any uncertainty or dispute over the election results may cause a fleeting knee-jerk sell-off in crude, but I don’t expect any enduring impact on prices right after the results, one way or another, whether it is a Trump or a Harris win,” Vandana Hari, founder and CEO of Singapore-based Vanda Insights, told Invezz.

Oil prices have had an indifferent year so far with prices remaining confined to a range between $70-$80 per barrel with periods of extreme volatility.

Hari said that any new policies, beneficial or detrimental to the upstream energy sector in the US could take time to flow through into production and influence prices.

Moreover, in case Trump wins the elections, his approach to more drilling of oil could add more supply to the oil market, which already has an adequate amount of crude.

“This would be the case at least if the oil supply from Iran did not decline at the same time due to a stricter implementation of the sanctions,” Commerzbank’s Fritsch said in a report.

In such a scenario, the Organization of the Petroleum Exporting Countries and allies will face an even tougher challenge in balancing the market.

OPEC+ is scheduled to increase oil production from December by reversing some of the voluntary output cuts.

“Therefore, OPEC+ would actually have to hope that Harris wins the election,” Fritsch said.

Hari added:

The other impact to look out for is how the next president influences the course of the Ukraine and Gaza wars, but that too is going to be a slow burn, leaving the market in a wait-and-watch mode rather than jumping in with bullish or bearish bets on oil prices.

The post US election spotlight: Donald Trump and Kamala Harris clash on energy and climate policies appeared first on Invezz