My job as a trader and mentor is to show my students what’s working in the market and how to turn it into profits.

That’s why I’m so excited that Mark Croock, one of my millionaire students, is revealing a brand new strategy, one he calls Shadow Trades next Thursday, June 2nd, at 8 PM ET.

He’s applied it to make six figures in less than 24-hours, and he swears it works in any type of market, even in a bear market.

Attendance is free, but you must register to gain access to the event.

Now, as a mentor, I’d be remiss if I didn’t come right out and say this…

Markets have NOT found a bottom.

I expect stocks to thrash around in the coming weeks with violent rallies and massive drops.

That’s why I’m dialed into simple setups that limit my risk while maximizing gains.

Right now, my favorite is the morning dip buy.

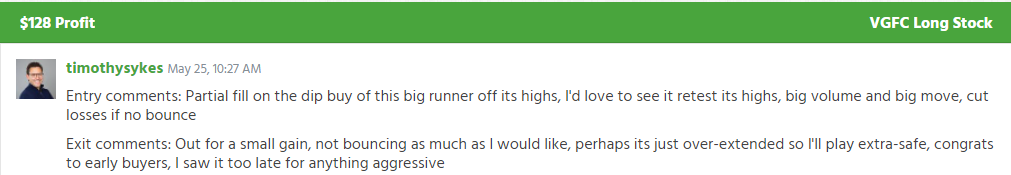

And the trade I took in The Very Good Food Co. Inc. (NASDAQ: VGFC) provides another great example of this setup.

I bought this stock AFTER it was up 200%!

Plus, it demonstrates two key concepts to surviving and thriving in this market.

Entries Matter

I know plenty of traders out there that say exits are the most important part of a trade.

At face value, that makes sense, especially when I trade explosive moves on penny stocks.

But here’s the thing…

If I don’t get the right entry, I’ll never make it to the exit.

Let me show you what I mean.

Take at the 1-minute chart of VGFC.

StocksToTrade Platform: VGFC 1-Minute Chart

I bought into this stock on the dip after shares peaked at around 47 cents.

My entry was just above 38 cents.

If you look at that range, the low up to that point was 38 cents.

Essentially, I was $0.007 off the lows.

Ideally, I wanted to see shares try to take out the highs at 47 cents. Otherwise, I could cut my losses when either:

- The stock dropped below the lows and didn’t appear as if it would rebound

- Volume declined and the stock traded sideways

In this case, I saw the latter, which has been more common this week.

From my entry point, the highest the stock got before my exit was just under 42 cents.

Based on my entry, when I saw the stock wasn’t going to continue, I exited the trade, but still managed to turn a profit.

Imagine if I had been impatient and chased the stock, buying at 40 cents instead of just above 38 cents.

That doesn’t seem like much if I’m looking for a run-up and through 47 cents.

However, my profit would have shrunk from $128 to $35.

What many traders don’t realize is that these small wins add up over time.

Plus, in this type of market, I don’t want to give stocks too much rope.

So when I cut trades, I’d rather make a couple of % rather than break even or even lose.

It might seem like such a small thing, especially with a small trading account.

But this is how I maximize my performance.

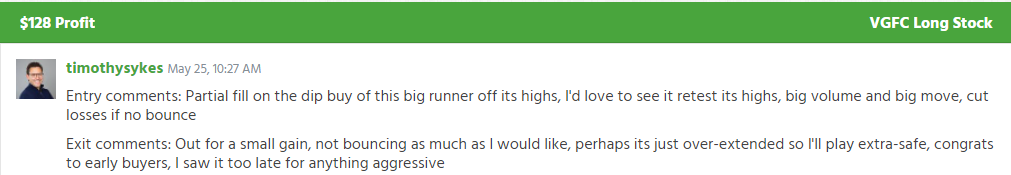

Treat Setups Individually

Let’s go back to the chart and highlight another area of importance…

StocksToTrade Platform: VGFC 1-Minute Chart

This consolidation point where the stock sold off offered a dip-buying opportunity long before I took the setup.

Several of my students managed to get in at this area and trade it for some incredible gains.

Since I missed the early entry, I had to look at my setup as a separate trade. I couldn’t let the setup that I missed influence my decisions.

So, rather than take an aggressive position, I lightened up (even when I only got a partial fill).

It would’ve been far too easy to chase this stock.

Early in my career, I let missed opportunities and losers push me into revenge trades. It’s a good way to decimate an account.

Now, I take each trade as it comes. If I feel like an earlier setup might influence my thinking, I take a step back, possibly avoiding all trades for the rest of the day.

Even when I take multiple trades in the same stock on the same day, I look at each independently.

Are You Up for a Challenge?

You want to become a better trader right now.

I’ve helped dozens of students that became millionaire traders.

I want to help you achieve your goals.

Sign up for my Trading Challenge and get started on your path to success.

Click here to sign up for my challenge.

The post I Bought a Stock up >200% and Made a Profit appeared first on Timothy Sykes.